New Limits on Charitable Tax Benefits Coming in 2026

As the end of 2025 quickly approaches, all taxpayers will have one last opportunity to review their tax planning and to consider making year-end gifts to one or more charities. This review is especially important this year because the recently enacted tax bill, the One Big Beautiful Bill Act (OBBBA), has codified two fairly significant changes that, effective next year, will reduce the tax deductions available for all future charitable gifts. Because of these impending changes, taxpayers who are considering making charitable gifts should reevaluate the amount of their year-end charitable gifts and consider accelerating future charitable gifts by making them this year. With only a few weeks left in 2025, there is a limited window to perform this analysis and to make this important decision.

What's Changing and How It Reduces Your Charitable Deduction

The two new OBBBA provisions will reduce the tax benefits of charitable giving starting next year, at least for those taxpayers who itemize their deductions. These two provisions are the following:

1. The 0.5 Percent AGI Floor

Starting in 2026, that portion of a donor's charitable gift equal to 0.5 percent of that donor's adjusted gross income (AGI) will no longer be deductible. That means that a donor with an AGI of $500,000 will lose the deduction for the first $2,500 of his or her charitable gifts. Only the portion of a donor's charitable gift above that contribution floor will be deductible.

2. The 35 Percent Cap on Tax Benefit

Taxpayers in the highest marginal income tax bracket will see the tax benefit of itemized deductions reduced. In 2025, each deductible charitable dollar saves these taxpayers about 37 percent in federal income taxes. Beginning in 2026, that benefit will be effectively limited to 35 percent. The OBBBA reduces itemized deductions by 2/37 of the lesser of total itemized deductions or the amount by which taxable income exceeds the 37 percent tax bracket threshold. While the difference may seem modest, this cap along with the new floor can work together to significantly reduce a donor's charitable deduction. The exact impact will vary based on each donor's individual circumstances, but the overall effect is a smaller federal tax benefit for itemized charitable deductions starting next year.

Important Note

Both the floor and the cap apply only to taxpayers who itemize their deductions. Individuals who claim the standard deduction will not be impacted by these limitations on itemized deductions.

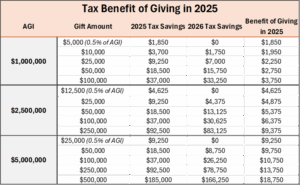

Comparing 2025 vs. 2026: The Impact on Charitable Gifts

Set forth below are two examples of two different sized charitable gifts. The first is a $10,000 gift by a donor with a $1,000,000 AGI. The second is a $100,000 gift by a donor with a $2,500,000 AGI. The calculations show the tax advantage of making each gift in 2025 rather than waiting until 2026. The table that follows provides a broader set of scenarios to show the benefit of giving in 2025 across a range of AGI and gift amounts.

1. Example: $10,000 Gift by Donor with $1,000,000 AGI

a. 2025 Law:

- The tax deduction is the full $10,000

- The actual tax savings is 37 percent × $10,000 = $3,700

b. 2026 Law:

- The 0.5 percent floor would be 0.5 percent × $1,000,000 = $5,000 (not deductible)

- The tax deduction would be $10,000 – $5,000 = $5,000

- The actual tax savings would be 35 percent × $5,000 = $1,750

c. Benefit of Giving in 2025:

- $3,700 – $1,750 = $1,950 (additional tax savings

2. Example: $100,000 Gift by Donor with $2,500,000 AGI

a. 2025 Law:

- The tax deduction is the full $100,000

- The actual tax savings is 37 percent x $100,000 = $37,000

b. 2026 Law:

- The 0.5 percent floor would be 0.5 percent × $2,500,000 = $12,500 (not deductible)

- The tax deduction would be $100,000 – $12,500 = $87,500

- The actual tax savings would be 35 percent × $87,500 = $30,625

c. Benefit of Giving in 2025:

- $37,000 – $30,625 = $6,375 (additional tax savings)

Consider Asset Appreciation

Obviously, an asset that is gifted in 2025 is likely to appreciate or depreciate in value if it is retained and not gifted until the end of 2026. While it may be virtually impossible to predict whether an asset will increase or decrease in value, it is clearly a factor that should be taken into account when considering the acceleration of charitable gifts. For example, if the $100,000 asset referred to in Example two above grows 10 percent over the next year, then that donor could still make his or her $100,000 gift at the end of next year and retain the additional $10,000 of growth. This $10,000 growth would outweigh the $6,375 loss in tax savings by $3,625, making the deferral of the gift until next year the better idea. Conversely, if that $100,000 asset declines 10 percent in value over the next year, then a donor who wants to make a $100,000 gift would have to come up with an additional $10,000 to make such gift, making the cost of deferral $10,000 plus $6,375, or $16,375. This would make the acceleration of the gift in 2025 a much better idea. Donors evaluating a gift acceleration might want to take this hard-to-predict factor into account when crunching the numbers. In addition, there is some benefit to taking a deduction this year versus taking it a year or two later. Arguably, the time value of money factor should also be part of a donor's calculations.

Year-End Strategy: How We Can Help You Capture the 2025 Advantage

The charitable deduction changes scheduled for 2026 create a narrow window for donors to secure more favorable tax treatment by acting before year-end. Those already planning meaningful charitable gifts soon may find it advantageous to complete those contributions during 2025.

If you're feeling rushed by the approaching year end, a donor-advised fund (DAF) can help bridge the gap—allowing donors to secure the 2025 deduction now while still taking time to thoughtfully choose the organizations they want to support. A contribution to a DAF this year preserves the deduction under current law while allowing charitable grants to be made later on a timeline that fits your goals.

With these changes approaching, Shumaker's Wealth Strategies Service Line is available to help evaluate options, run the numbers, and design a giving strategy that supports both your charitable objectives and your broader planning needs. We wish you and your family a warm and joyful holiday season and a prosperous New Year.

Special thanks to Toledo Law Clerk, Dan Corwin, for authoring this article.