This Client Alert serves to update and supplement our Client Alerts of April 9, 20201 and May 1, 2020,2 relating to the Main Street Lending Program.

Current Main Street Lending Program:

The long-awaited $600 billion Main Street Lending Program ("MSLP") established by the Board of Governors of the Federal Reserve System (the "Fed") and to be administered by the Federal Reserve Bank of Boston ("Boston FRB") was officially launched on Monday, June 15, 2020.

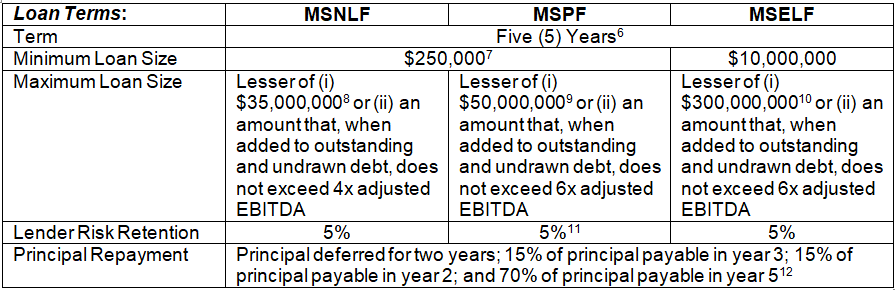

The MSLP, which was initially announced by the Fed on April 9, 2020,3 with further revisions rolled-out on April 30, 20204 and June 8, 2020,5 currently consists of three separate facilities, the Main Street New Loan Facility ("MSNLF"), the Main Street Priority Facility ("MSPF"), and the Main Street Expanded Loan Facility ("MSELF"). The final basic terms of each of the existing facilities are set forth in the below chart:

The Boston FRB has published Frequently Asked Questions (FAQs) for the MSLP, which can be found at the following link: https://www.bostonfed.org/mslp-faqs

Additionally, term sheets for each of the existing MSLP facilities detailing their respective terms may be found at the below links:

MSNLF: https://www.federalreserve.gov/newsevents/pressreleases/files/monetary20200608a1.pdf

MSPF: https://www.federalreserve.gov/newsevents/pressreleases/files/monetary20200608a2.pdf

MSELF: https://www.federalreserve.gov/newsevents/pressreleases/files/monetary20200608a3.pdf

In order to participate in the MSLP, a lender must be a federally insured depository institution (bank, savings association, or credit union), a U.S. branch or agency of a foreign bank, a U.S. bank holding company, a U.S. savings and loan holding company, a U.S. intermediate holding company of a foreign banking organization, or a U.S. subsidiary of any of the foregoing. Additionally, lenders wishing to participate in the program must register to participate through the Boston FRB's Main Street Lending Portal at https://www.bostonfed.org/supervision-and-regulation/supervision/special-facilities/main-street-lending-program.aspx. Registration requires that a lender submit written certifications as to eligibility and agree to required covenants relating to Section 13(3) of the Federal Reserve Act, the Coronavirus Aid, Relief, and Economic Security (CARES) Act, the Fed's Regulation A, and the term sheets for each of the MSLP facilities, as set forth in the Main Street Lending Program Registration Certifications and Covenants (found on the Boston FRB's Main Street Lending Portal), which must be signed by both the principal executive officer and the principal financial officer of the registering lender. Additionally, the lender is required to submit a Lender Wire Instructions Direction (again found on the Boston FRB's Main Street Lending Portal), which must be signed by the registering lender's principal financial officer.

Under the MSLP, the Fed has established MS Facilities LLC, a special purpose vehicle, to purchase 95% participation interests in eligible loans under each of the MSNLF, the MSPF, and the MSELF. In order to do so, lenders participating in the MSLP must enter into a form Participation Agreement Under the Main Street Program Transaction Specific Terms, which incorporates the Participation Agreement Under the Main Street Program Standard Terms and Conditions, both of which can be accessed through the Boston FRB's Main Street Lending Portal. Additionally, each borrower is required to execute Borrower Certifications and Covenants and the lender is required to execute Lender Transaction Specific Certifications and Covenants, in each case, specific to each of the three MSLP programs. A participating lender is further required to execute an Assignment Executed In Blank, as well as a Co-Lender Agreement under the Main Street Program Transaction Specific Terms for bi-lateral loans and a Servicing Agreement, which provides for the payment of the annual 25-basis point servicing fee that MS Facilities LLC is required to pay the lender for servicing and reporting services. Forms of each of these documents may be found at the Boston FRB's Main Street Lending Portal.

Proposed Not for Profit Facilities Under MSLP:

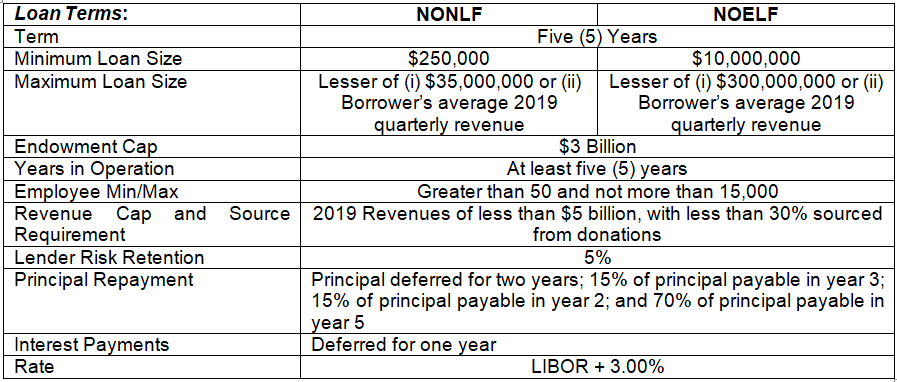

On Monday, June 15, 2020, the Fed also announced13 that it is seeking public feedback on proposals to expand the MSLP to provide nonprofit entities with loans through two (2) facilities, the Nonprofit Organization New Loan Facility ("NONLF") for new loans and the Nonprofit Organization Expanded Loan Facility ("NOELF") for additional tranches to existing loan facilities. In order to be eligible, a borrower must (i) be a tax-exempt organization under Internal Revenue Code Sections 501(c)(3) or 501(c)(19), (ii) have a minimum of 50 but not more than 15,000 employees, (iii) an operational history of at least 5 years, and (iv) a limit on endowments of no more than $3 billion. Each of the two facilities would differ from the existing MSLP facilities in that financial thresholds would be based on operating performance, liquidity, and the ability of the borrower to repay debt.

The basic proposed terms of each of the not for profit facilities are set forth in the below chart:

Drafts of the term sheets for these two nonprofit facilities detailing their respective terms may be found at the below links:

NONLF: https://www.federalreserve.gov/newsevents/pressreleases/files/monetary20200615b2.pdf

NOELF: https://www.federalreserve.gov/newsevents/pressreleases/files/monetary20200615b1.pdf

Comments on the proposed nonprofit facilities are due by Monday, June 22, 2020, and may be made directly to the Fed staff at https://www.federalreserve.gov/apps/contactus/feedback.aspx?refurl=%2FmainLending%2F

Shumaker's Financial Services practice group has extensive experience in representing both financial institutions and commercial borrowers in a variety of transactions and structures, in all areas of commercial lending. We have a team prepared to advise clients on participating in the Main Street Lending Facilities and are ready to assist. Please contact us if you have questions regarding this Client Alert or if we can otherwise be of assistance in connection with the MSLP or issues involving credit transactions generally.

For the most up-to-date legal and legislative information related to the coronavirus pandemic, please visit our Shumaker COVID-19 Client Resource & Return-to-Work Guide at shumaker.com. To receive the latest news and updates regarding COVID-19 straight to your inbox, sign up here.

1 Shumaker, Loop & Kendrick, LLP, Client Alert: Federal Reserve System Announces Main Street Loan Facilities to Support Small and Medium-Sized Businesses (Apr. 9, 2020), https://www.shumaker.com/latest-thinking/publications/2020/04/client-alert-federal-reserve-system-announces-main-street-loan-facilities-to-support-small-and-medium-sized-businesses.

2 Shumaker, Loop & Kendrick, LLP, Client Alert: Federal Reserve Announces Expansion, Changes to Main Street Lending Program (May 1, 2020), https://www.shumaker.com/latest-thinking/publications/2020/05/client-alert-federal-reserve-announces-expansion-changes-to-main-street-lending-program

3 Press Release, Board of Governors of the Federal Reserve System, Federal Reserve takes additional actions to provide up to $2.3 trillion in loans to support the economy (Apr. 9, 2020, 8:30 AM), https://www.federalreserve.gov/newsevents/pressreleases/monetary20200409a.htm

4 Press Release, Board of Governors of the Federal Reserve System, Federal Reserve Board announces it is expanding the scope and eligibility for the Main Street Lending Program (Apr. 30, 2020, 10:00 AM), https://www.federalreserve.gov/newsevents/pressreleases/monetary20200430a.htm

5 Press Release, Board of Governors of the Federal Reserve System, Federal Reserve Board expands its Main Street Lending Program to allow more small and medium-sized businesses to be able to receive support (June 8, 2020, 3:30 PM), https://www.federalreserve.gov/newsevents/pressreleases/monetary20200608a.htm

6 Prior terms provided for a maximum term of four (4) years.

7 Prior terms provided for $500,000 minimum loan size.

8 Prior terms provided for $25,000,000 maximum loan size.

9 Prior terms provided for $25,000,000 maximum loan size.

10 Prior terms provided for $200,000,000 maximum loan size.

11 Prior terms required a 15% risk retention by the Lender.

12 Prior terms for MSNLF provided for one year of principal deferral with one-third of the Loan being repayable in each of years 2 through 4 and prior terms for the MSPF and MSELF facilities provided for principal deferral for one year with 15% of the Loan being due in each of years 2 and 3 and 70% of the Loan being due in year 4.

13 Press Release, Board of Governors of the Federal Reserve System, Federal Reserve Board announces it will be seeking public feedback on proposal to expand its Main Street Lending Program to provide access to credit for nonprofit organizations.(Jun. 15, 2020, 5:15 PM), https://www.federalreserve.gov/newsevents/pressreleases/monetary20200615b.htm.